Bo Stump featured in Axial's 2023 Consumer M&A Market Outlook

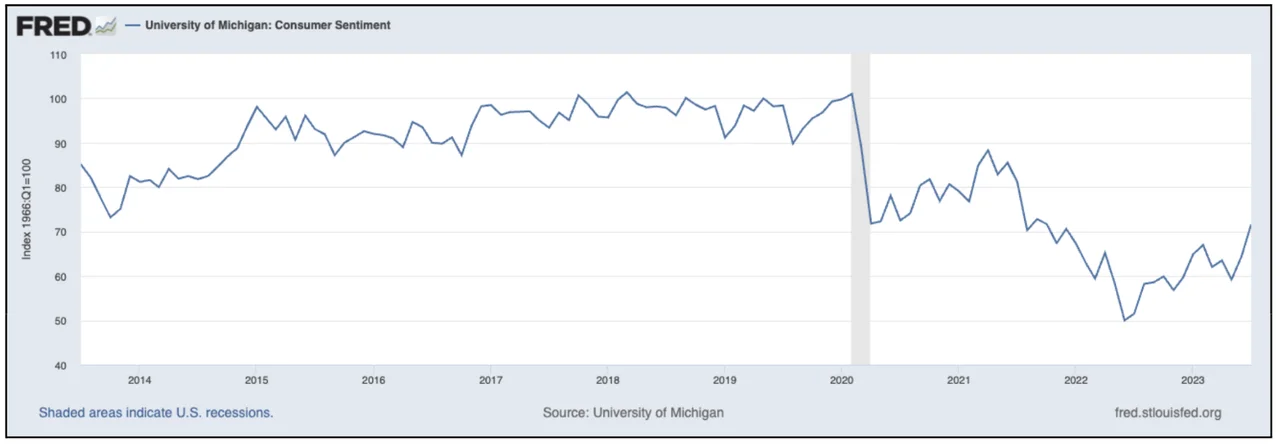

For over a decade, the consumer sector experienced stability and consistency as customers demonstrated a positive sentiment related to their economic situation and the future developments of their households’ consumption and savings. Then came the COVID-19 pandemic in 2020, inducing not only a lack of consumer confidence but also a shift in consumption behaviors.

U.S. Consumer Sentiment (2013-2023)

As the long-term effects of the pandemic on the consumer sector continue to evolve in today’s post-pandemic environment, we thought it was a prescient time to check in with some of the M&A investment bankers and consumer acquirers on Axial’s platform.

Axial surveyed 26 consumer focused dealmakers about the current challenges and opportunities as they navigate an evolving market. Our findings are structured in 4 sections:

- The Leading & Lagging Sub-Sectors

- Strategic Priorities For Operators

- Strategic Priorities For Investors

- Near Term Market Outlook

This article cites 18 of these members. We are grateful for their contributions and perspectives:

- Carl Cordova, Managing Director of Investment Bank, Auctus Capital Partners

- Bryce DeGroot, Managing Director of M&A Advisory Firm, Compass Advisors

- Jacob DuBois, Managing Partner of M&A Advisory Firm, Eagle Pointe Capital

- Erik Endler, Managing Director of Investment Bank, 321 Capital Partners

- Alex Fridman, Partner of Investment Bank, Peakstone Group

- Sally Anne Hughes, Partner of M&A Advisory Firm, Hughes Klaiber

- Trevor Hulett, Managing Director of Investment Bank, R.L. Hulett

- Dena Jalbert, CEO of M&A Advisory Firm, Align Business Advisory Services

- Chris Masoud, Director of Family Office, Group 206

- Scott Mitchell, Managing Director of Investment Bank, SDR Ventures

- Matt Parsons, Managing Partner of Family Office, Camp Lake Capital

- Arthur Petropoulos, Managing Partner of M&A Advisory Firm, Hill View Partners

- Ben Rudman, CEO of Holding Company, Charis Consumer Collaborative

- Charles Saleh, President of M&A Advisory Firm, The BuySell Consortium

- Todd Slater, Managing Director of Investment Bank, Young America Capital

- Bo Stump, Partner of Investment Bank, Stump & Company

- Jason Ward, Founder of Business Brokerage Firm, TruView Business Advisors

- Leah White, Managing Director of Investment Bank, FOCUS Investment Banking

The Leading & Lagging Sub-Sectors

According to Chris Masoud, Director of Family Office, Group 206, the biggest challenge today is “understanding the normalized growth or earnings of any sub-sector due to COVID bumps or troughs.” These COVID induced abnormalities are making it difficult for the market to understand which sub-sectors will lead or lag in today’s market.

Scott Mitchell, Managing Director of Investment Bank, SDR Ventures says “there is a lot of volatility in many consumer oriented businesses right now.” He predicts that in the current market environment, “consumer-centric businesses that offer products that are more discretionary in nature (e.g. high-end branded products, luxury services, and retail)” will underperform, while “consumer-centric businesses that can demonstrate counter-cyclical behavior” will continue to overperform.

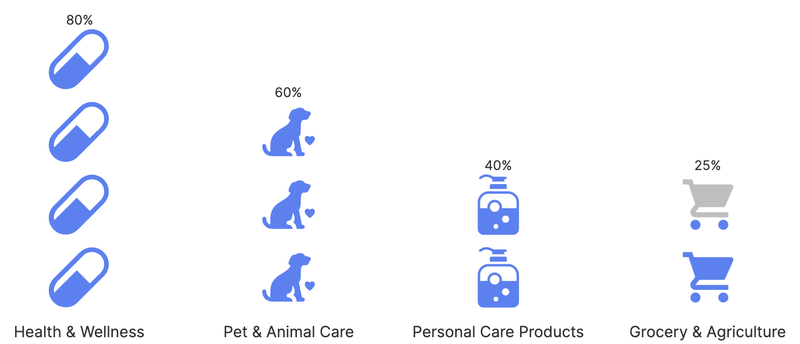

The Leading Sub-Sectors

Health & Wellness, Pet Products, Personal Care Products, and Grocery ranked as the top 4 leading sub-sectors based on survey responses.

The Leading Consumer Sub-Sectors

Health & Wellness ranked as #1 with over 80% of surveyed Axial members demonstrating a bullish sentiment in performance. Pet Care and Personal Care ranked #2 and #3 respectively, with 60% and 40% of surveyed members exhibiting positive outlooks for the sub-sectors, respectively.

The common theme in the top 3 sub-sectors is the essential nature of the products that are sold within each of them. These are products with stable demand that can weather the ebbs and flows of a cyclical market.

Grocery ranked as #4 with only 25% of respondents feeling bullish about the sub-sector. A few survey respondents are particularly optimistic about Grocery due to the tactful nature of how businesses are dealing with higher input costs. Ben Rudman, CEO of Holding Company, Charis Consumer Collaborative says, “in certain areas like food, we’re still seeing inflation. That said, retailers aren’t just accepting price increases like before.” He adds that some of these retailers with “the absolute best competitive positioning and demand inelastic offerings are able to cleanly pass price increases through to the customer.”

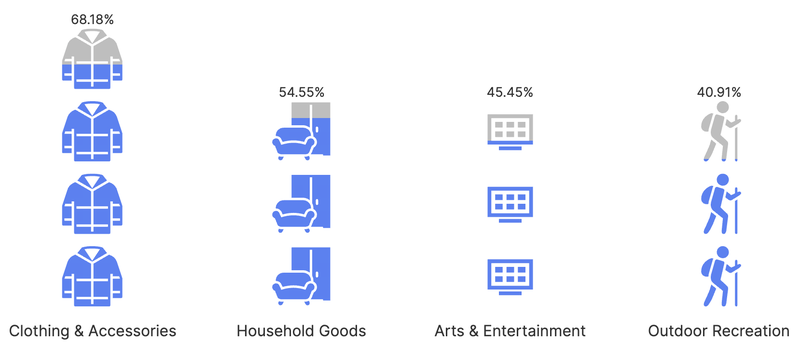

The Lagging Sub-Sectors

Survey responses suggest that Clothing, Households Goods, Arts & Entertainment, and Outdoor Recreation are the top 4 sub-sectors to underperform.

The Lagging Consumer Sub-Sectors

Clothing & Accessories ranked as #1 with 68% of surveyed Axial members demonstrating a bearish sentiment in performance. Household Goods ranked #2 with 54% of respondents indicating a negative outlook. Entertainment & Outdoor Recreation ranked as #3 and #4 respectively, with 45% and 40% of members exhibiting dreary performance for the sub-sectors.

The common theme in each of these 4 sub-sectors is the discretionary nature of the products, and their inability to withstand counter-cyclical consumer behavior.

Strategic Priorities For Operators

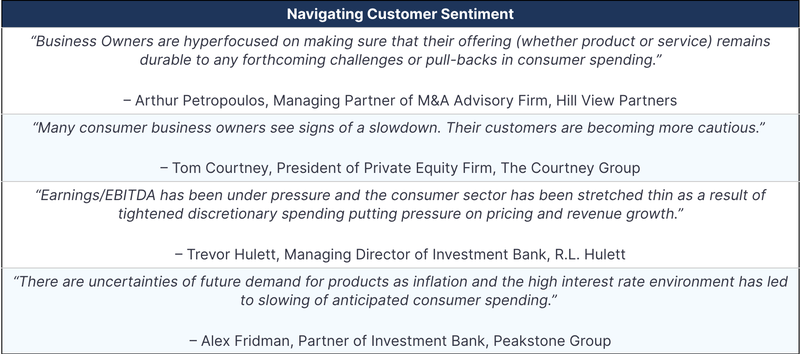

Survey respondents unanimously agreed that there is a broader sense of uncertainty in the market due to the current macroeconomic conditions. As a result, navigating consumer spending pull-backs, restricted capital access, and operational challenges are key priorities for consumer operators.

Inflation & Consumer Sentiment

Erik Endler, Managing Director of Investment Bank, 321 Capital Partners says, “business owners are worried about economic headwinds and overall consumer sentiment.”

Many survey respondents share Erik’s belief and agree that navigating demand is top of mind for consumer operators. To do so, many operators are assessing the durability of their products and services with a fine-tooth comb.

According to Matt Parsons, Managing Partner of Family Office, Camp Lake Capital, the slowdown in consumer spending is also “impacting the timing of when business owners go to market in certain sectors, particularly those that are consumer discretionary.”

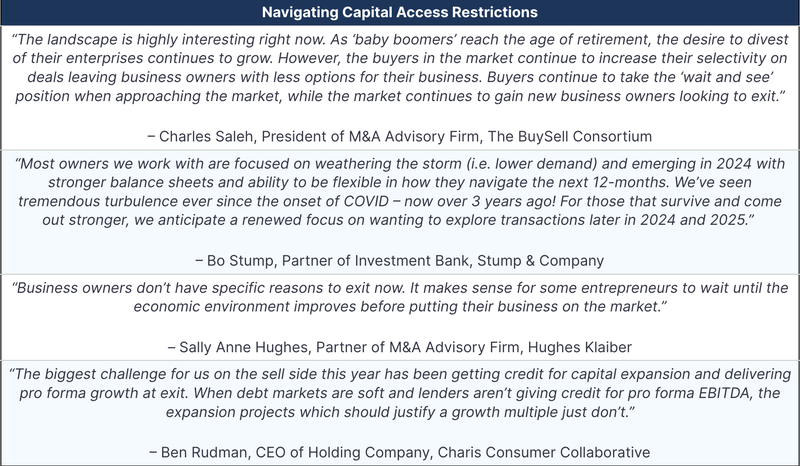

Restricted Access To Capital

Restricted capital access is also top of mind for consumer operators as they try to grow their business or explore a sale in an uncertain environment. Dena Jalbert, CEO of M&A Advisory Firm, Align Business Advisory Services comments “debt is too expensive, so to be able to make investments in scaling, consumer operators need a partner as traditional capital sources are tight in today’s market.”

Aside from the consideration associated with growth, the tightness in capital is also leading some consumer operators to think critically about when they’d like to exit their business.

For those who are looking to weather the storm prior to a transaction, operating challenges continue to remain an area of key focus to position their businesses for the best possible outcome.

Operational Challenges

According to Scott Mitchell, Managing Director of SDR Ventures, “many consumer businesses are facing margin compression.” Some of the key challenges that are leading to this compression include ongoing supply chain issues, increased expenses, and eCommerce complexities.

Sally Anne Hughes, Partner of M&A Advisory Firm, Hughes Klaiber feels that while these challenges are hard to navigate, they also present “an opportunity to tweak operations, look for new pockets of distribution growth, and execute plans to ensure the business is well positioned for growth in 2024 and beyond.”

Charles Saleh, President of M&A Advisory Firm, The BuySell Consortium feels that the factors above “continue to contribute to shortages and inefficiencies in consumer markets.” Executing on these challenges is a fundamental element of generating investor demand for a potential transaction.

Strategic Priorities For Investors

The priorities for consumer investors are being fueled by continued uncertainty caused by the current macroeconomic conditions combined with the long term implications of COVID-19 on business performance. Consumer investors are hyper focused on navigating the challenges associated with increased cost of capital, unpredictable forward product demand, and misaligned valuation expectations.

Rising Cost Of Capital

Survey responses suggest that consumer investors are finding it hard to transact in today’s environment due to the tightening debt markets.

The elevated concerns of rising interest rates make it challenging for consumer investors to underwrite deals that would have once been favorable. As investors continue to source consumer opportunities, understanding forward demand for each business offering is a top priority for their investment decision.

Focus On Forward Demand

Some respondents feel that it may be worthwhile to wait on the sidelines given the ongoing challenges associated with forecasting forward looking performance. Erik Endler, Managing Director of 321 Capital Partners says, “the biggest challenge for investors is figuring out rational forecasts in light of the current economic environment. It is hard to tell whether pandemic-induced highs or lows (depending on the company) will be repeated. We need another year of a ‘normal’ operating environment.”

Other respondents feel that today’s environment presents opportunities to make synergistic transactions if there aren’t possibilities for standalone growth. Sally Anne Hughes, Partner of Hughes Klaiber says, “it’s challenging finding companies with strong growth in this economic environment. However, on the flip side, there are multiple opportunities to acquire companies with operational synergies that can be acquired for reasonable valuations.”

A few respondents like Ben Rudman, CEO of Charis Consumer Collaborative, feel that despite the current challenges with forecasting demand, investments can still be made if the right situation presents itself. He says, “it’s paramount to validate forward demand and feel confident that margins will at least hold. Recent history has made this difficult, but if you’re willing to roll up your sleeves and understand the business, you can find the right situations in which to invest.”

Misaligned Valuation Expectations

For investors who are willing to transact in today’s market, there continue to remain challenges associated with misaligned valuation expectations due to the uncertainty associated with forward looking demand.

Trevor Hulett, Managing Director of Investment Bank, R.L. Hulett comments “it is challenging for investors to get comfortable with seller expectations on valuation, underwrite EBITDA anomalies and determine EBITDA sustainability if they do see a recession in 2024.”

Bryce DeGroot, Managing Director of M&A Advisory Firm, Compass Advisors agrees with Trevor’s sentiments and comments, “buyers are navigating valuation gaps as they seek to gain confidence in growth and margins.”

In 2022, Axial launched The Winning LOI series, a bi-monthly publication that surfaces the winning bids of Axial-sourced transactions, with a focus on key deal terms, including financials, multiples, earn-out structures, and deal-specific diligence requirements. All data is fully anonymized to protect the confidentiality of Axial members and transactions. Both sellers and investors can leverage this data to better understand the valuations and deal structures of comparable businesses that recently sold in the market.

Near Term Market Outlook

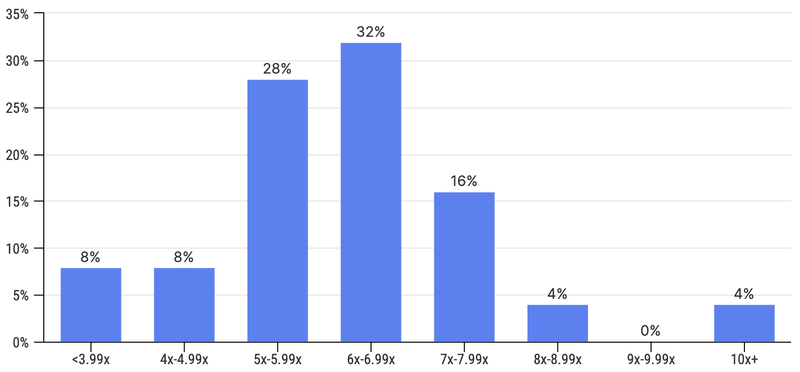

Over 76% of survey respondents indicated that they either paid or received an average multiple between 5x and 7.99x of adjusted EBITDA on consumer transactions.

Average Multiple On Adjusted EBITDA

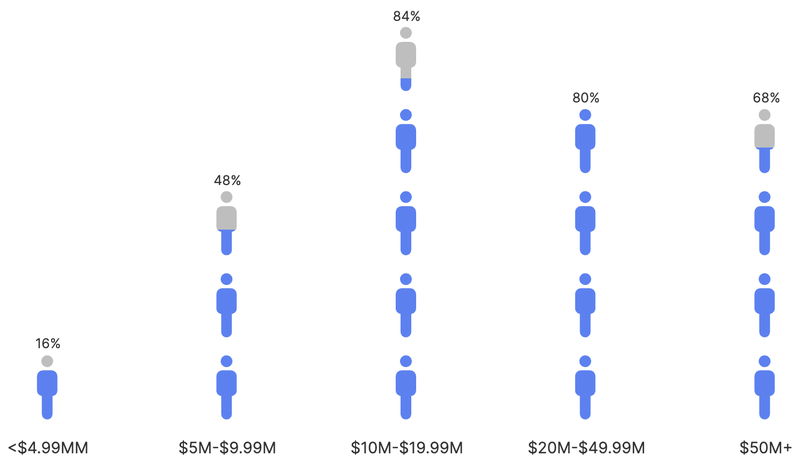

The vast majority of these surveyed dealmakers indicated that they transacted on opportunities with a Total Enterprise Value between $10M and over $50M.

Size Breakdown For Consumer Transactions (Total Enterprise Value)

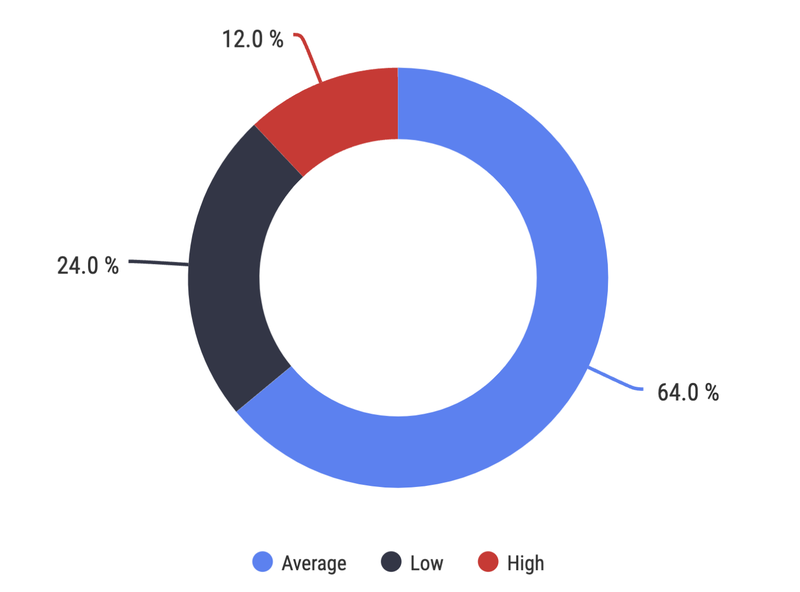

When polled about their sentiment on current valuations of consumer deals, 64% indicated that multiples remain average.

Current Valuations Of Consumer Deals

Many respondents feel that consumer valuations have now reverted back to the mean after experiencing a peak in recent years. Higher interest rates are certainly contributing to this decline. According to Trevor Hulett, Managing Director of R.L. Hulett, “valuations have come down from the peak levels in 2021 as lenders have pulled back and cost of capital has increased”. Several investors agree with Trevor’s comment. “Many buyers and lenders are being cautious,” says Tom Courtney, President of Private Equity Firm, The Courtney Group.

The declining profitability of the consumer sector is also contributing to valuation adjustments. “Multiples for the consumer sector are down right now because of concerns about how the forecasted recession will impact consumer balance sheets and consumer spending,” says Scott Mitchell, Managing Director of SDR Ventures.

While the consumer sector in aggregate may be experiencing a downward valuation trend, Todd Slater, Managing Director of Investment Bank, Young America Capital says, “deal multiples vary widely depending on numerous variables such as industry niche, size of the market, past/present financial performance/growth rates, margin potential, disruptive or differentiated nature of the product or brand, and experience level of the management team.”

Continued Demand For High Quality Businesses

The surveyed dealmakers feel that quality consumer business will continue to generate high demand and command high multiples in today’s market. Ben Rudman, CEO of Charis Consumer Collaborative comments,“ companies with long-term customer visibility, sustainable margins and a track record of efficiently deploying capital toward expansion or M&A will always command premium multiples. Companies that lack some of these components are trading for significantly lower multiples than before, if at all.”

Sally Anne Hughes, Partner of Hughes Klaiber, agrees with Ben. She says, “a smaller percentage of brands have been able to drive recent growth and have a compelling story regarding future growth. We’re seeing a wider range of valuations, with top-performing and growing companies able to stand apart.”

Trevor Hulett, Managing Director of R.L. Hulett says, “it is a seller’s market for A+ quality assets and a buyer’s market for everything else due to increased cost of capital resulting in more selectivity by buyers.”

Strong Outlook On Acquirers With Robust Capital Sources

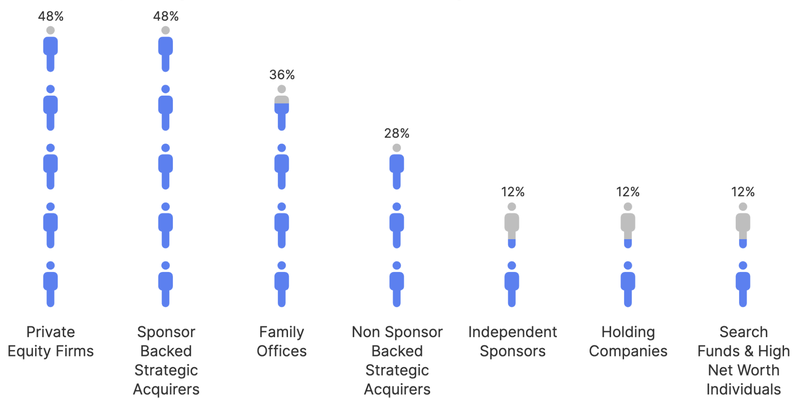

Private equity firms, sponsor backed strategics, and family offices will be the most active acquirers over the next 6-12 months based on survey responses. Over 48% of respondents indicated that they anticipate both private equity firms and sponsor backed strategics to be active, while 36% indicated that they anticipate family offices to be acquisitive.

Who do you expect to be the most active acquirers in the next 6-12 months?

Carl Cordova, Managing Director of Investment Bank, Auctus Capital Partners says, “The amount of dry powder and volume of private equity groups chasing opportunities in the lower middle market is truly staggering.”

Ben Rudman, CEO of Charis Consumer Collaborative, also has a bullish sentiment towards private equity firms due to their incentive structure. He comments, “private equity is incentivized to raise capital and deploy it so long as they can deliver enough returns to stay in the game. Individuals working at LPs are not incentivized to call out where they could be better, which creates a virtuous cycle wherein private equity has become the most market inelastic buyer set that exists.”

Bo Stump, Partner of Investment Bank, Stump & Company anticipates sponsor backed strategics to remain active as they attempt to keep growing inorganically prior to an exit. He says, “we are seeing PE-backed companies assessing how much road they have left with their current sponsor. In many cases, the downturn in the market has led management to realize they have another 2+ years left, whereas in 2021 they may have been planning an exit in 2023-2024. As that now seems unlikely, many of these companies are looking to acquire complementary businesses for a relatively lesser value than 1-2 years ago, bolster the combined portfolio company, and then pursue a successful exit in 2025.”

Hill View Partners feel that sponsor backed strategics may be able to take greater risk in today’s environment given their margin of safety. “A sponsor backed strategic that will ultimately sell at 10x+ EBITDA still has some margin of safety if they’re acquiring businesses ~6x,” says Arthur Petropoulos, Managing Partner of M&A Advisory Firm, Hill View Partners.

According to Erik Endler, Managing Director of 321 Capital Partners, “family offices are also uniquely positioned to do deals right now given their ability to take a longer-term viewpoint.” He adds that they “can generally get past near-term headwinds.”

Jason Ward, Founder of Business Brokerage Firm, TruView Business Advisors is also bullish on family offices given their long term outlook. He says, “family offices are more likely to take the long-term outlook and not be spooked by the high-interest rates that may be a hindrance to individual or search fund buyers.”

Takeaways

Takeaways For Operators

Maintaining a strong pulse on spending pull-backs and navigating the operational challenges that are leading to margin contraction is top of mind for consumer operators.

Experienced operators focused on maintaining or performing above historical sales can introduce new product offerings, implement new distribution channels, and strengthen customer loyalty. On the other hand, operators focused on reversing margin contraction can optimize ad-spend and focus on flowing higher input costs to the end customer.

Consumer businesses offering essential products that demonstrate counter cyclical purchase behavior will likely be able to execute on these plans more seamlessly, while businesses that offer discretionary products may face elevated challenges in doing so.

Consumer operators serving essential sub-sectors may continue to witness strong demand for their businesses if they explore a transaction, but operators serving discretionary sectors may need to wait on the sidelines due to the scarcity in demand.

Takeaways For Investors

Increased cost of capital and unpredictable product demand are top of mind for consumer investors.

Many investors are approaching the consumer sector with caution, and placing a heightened focus on understanding the forward demand for the offerings of the businesses they evaluate. To succeed, it will be important for investors to thoroughly understand each business so that they can find the right situation to invest in. Consumer investors may lean more heavily towards essential consumer products that are easier to underwrite given the persisting demand associated with them.

Over the next 6-12 months, private equity firms, family offices, and sponsor backed strategics will likely be the most active investors in consumer M&A. Private equity firms will remain inelastic to market conditions given their incentive to deploy dry powder, while family offices may discount near term rate increases due to their long term investment approach. Sponsor backed strategics may also acquire complementary businesses as they attempt to grow organically prior to exploring a sale in the years to come.

Related News

Stump M&A team talks furniture industry turmoil on BOH Podcast

Stump M&A team talks furniture industry turmoil on BOH Podcast

Why M&A is Good for the Furniture Industry

Why M&A is Good for the Furniture Industry

Putting the Recession in Perspective

Putting the Recession in Perspective

Will China’s military drills near Taiwan affect the furniture industry?