A Choppy, Disruptive Market: High Point Fall Market 2024

The Stump team spent six days at the Fall High Point Furniture Market. The weather was brisk and sunny - a perfect time to be in North Carolina and get our 10,000 steps in. The High Point market now encompasses over 12 million square feet of showroom space with over 2,000 exhibitors. We enjoyed catching up with many of them, as well as long-time industry clients, colleagues and friends.

The climate in the halls was not quite as sunny as the weather outside, as the industry continues to push forward in a challenging demand environment. The general sentiment - and question that seemed to be posed around every corner and showroom was - “When is the home furnishings sector going to pick back up?”

A bright spot was the higher-end manufacturers and sellers focused on the interior designer trade. We heard of many companies experiencing solid, profitable growth servicing this high-end segment. With over 100,000 designers (per ASID) nationwide, this is an attractive $18 billion + cohort that continues to spend on higher-end home furnishings.

Our general feeling is the turnaround for the broader industry is somewhere on the other side of the election and additional interest rate drops (given the propensity for home sales to be a primary driver of furniture purchasing). Most companies are slightly down this year vs. 2023 (revenues), though there are a few stand-out performers that are meaningfully outperforming the averages.

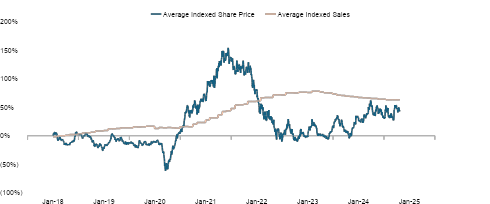

The public data we are seeing suggests that revenue declines are flattening and share prices for the publics are ticking upward. Hopefully this suggests the broader market will see better days ahead. We are optimistic about mid-2025 and beyond.

(Please let us know if you are interested in seeing more public comps data - you can sign up to receive the Stump quarterly report here!)

We had the opportunity to sit down with industry CEOs and these were the topics that were most top of mind:

Political Fatigue

With the market being relatively late in October, this year’s market is within mere days of election day. We were reminded several times how much more expensive advertising is for furniture retailers during election season, given the unlimited TV ads running for both sides. There was a general desire to get on the other side of the election and back to business. And hopefully growth.

Global Disruptions

Chinese manufacturers continue to disrupt the status quo. We are hearing of manufacturers going direct to retailers or consumers (“MtC” Manufacturer to Consumer as it has been coined). This is also being facilitated by e-commerce players like Amazon and Wayfair, and newer entrants into the US home furnishings space like Temu and Shein, allowing lower-price goods to flow into the US. This naturally leads to further conversations about the Chinese – US Tariffs and the potential for additional tariff action following the election next week.

The wars in Eastern Europe and the Middle East came up frequently, and there was a collective concern that either of these conflicts could escalate into a larger war which could throw further chaos into an already disrupted global Economy. The European market in particular is being impacted by these conflicts, as they struggle with a tough economic climate and fear of further Russian aggression. This reality is leading to a new wave of European investors seeking to enter the US, a larger single market with perceived greater growth opportunity.

Investments in People, Processes, and Product

For many Companies, management is treating the slower demand environment as an opportunity to work on internal business: ensuring a streamlined and lean organization (no redundant head counts and exceptional talent for key positions), technology implementations to improve data collection and analysis, and a focus on its core products and services that matter the most to customers. It is important to be vigilant and cut only fat, not muscle.

The Destiny of Demographics

There is a general sense that once the market improves the furniture industry will have a strong multi-year run. The macro demographic impact of Millennials moving into larger homes and starting families (albeit delayed) and the renovations and refurbishments that will come from baby boomers eventually downsizing will drive meaningful furniture industry growth.

M&A

The Stump team remains busy and looks forward to announcing several transactions in the coming months.

Interested in buying or selling a Company? Give us a call to start the conversation.

As one Industry friend shared, “price is what you pay, value is what you receive.”

We will be back on the road in 2 weeks for the annual Boutique and Design NY show, BDNY - a great event for the Hospitality Furnishings Industry. We look forward to seeing many of you there!

Related News

Fall 2025 High Point Market Recap

Fall 2025 High Point Market Recap

NeoCon & Design Days Recap 2025

NeoCon & Design Days Recap 2025

Everyone Loves Green: M&A on Display in Nashville

Everyone Loves Green: M&A on Display in Nashville

HD Expo Recap